Empower Tomorrow!

insurance solutions for a stronger, worry-free future.

Live Confident!

services that bring peace of mind and prosperity.

Our Mission!

toward financial stability and long-term success.

Health Insurance

General Insurance

Our Mission

We at Aarambh Associates are committed to cultivate financial well-being and growth for our clients through strategic consulting and proactive solutions, building a secure future together.

Our Vision

To be the trusted partner in insurance empowering individuals and businesses to achieve their financial aspirations and secure their futures through expert financial planning, comprehensive insurance solutions, and a vibrant network of opportunities.

With a selection of our thought

leadership white papers by some

of the world’s leading

With a selection of our thought

leadership white papers by some

of the world’s leading

With a selection of our thought

leadership white papers by some

of the world’s leading

We have over 10 years experience

Aarambh Associates is a trusted financial firm dedicated to empowering individuals and businesses through strategic financial planning and comprehensive insurance solutions.

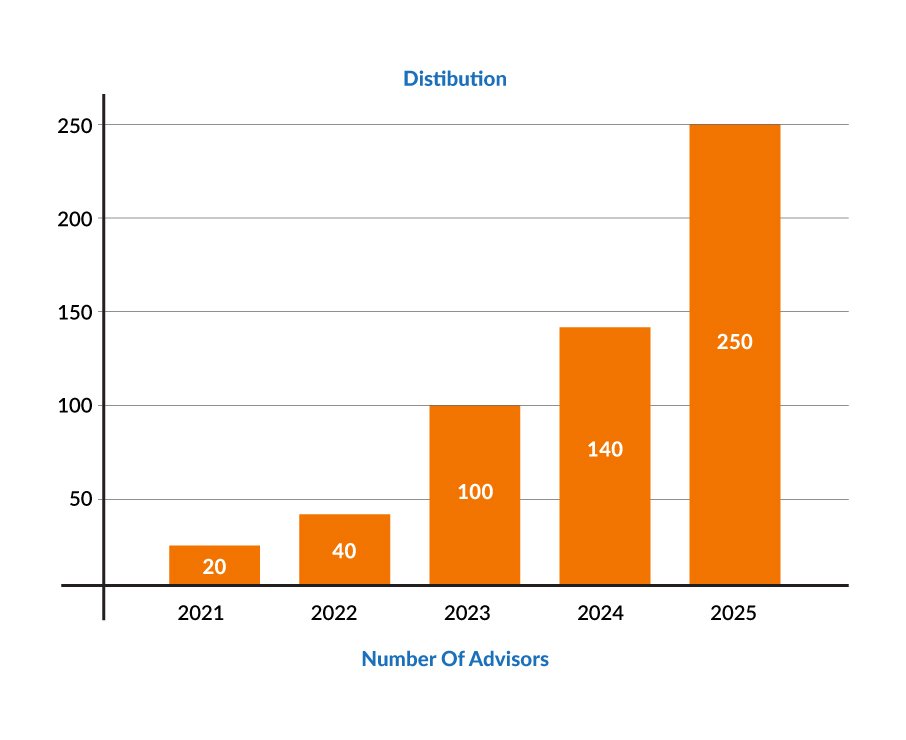

Advisors

Successful Leaders

Satisfied Customers

Let’s Meet!

Whether you’re looking to protect your assets, plan for your future, or explore a rewarding freelance opportunity, Aarambh Associates is here to help.

Our services:

Financial planning is a comprehensive process that helps individuals and families manage their finances to achieve specific life goals. It involves analyzing your current financial situation, setting short- and long-term objectives, and developing strategies to reach them. A good financial plan covers various aspects such as budgeting, saving, investing, tax planning, retirement planning, and estate planning. With professional guidance, you can prioritize your goals, allocate resources efficiently, and make informed financial decisions. Whether you're planning for a child's education, buying a home, or preparing for retirement, financial planning offers a structured approach to managing income and expenses. It also includes risk assessment and contingency planning to prepare for unforeseen circumstances, such as job loss, market fluctuations, or health issues. By regularly reviewing and updating your financial plan, you can stay on track as your life circumstances and economic conditions change. Ultimately, financial planning provides peace of mind by promoting financial stability and helping you build wealth over time. It empowers you to live confidently today while securing your financial future.

Life insurance is a contract between you and an insurance provider that guarantees a payout to your beneficiaries in the event of your death. It is designed to provide financial protection and peace of mind to your loved ones by replacing lost income, covering debts, and funding future needs such as education or daily living expenses. There are various types of life insurance policies available, including term life, whole life, and universal life insurance, each offering different benefits and features. Term life provides coverage for a specific period, typically offering higher coverage at lower premiums, while whole and universal life policies include a savings or investment component that builds cash value over time. Choosing the right policy depends on your age, financial obligations, and long-term goals. Life insurance is especially important if you have dependents or financial commitments that would be difficult to manage in your absence. It not only helps maintain your family’s standard of living but can also cover final expenses such as funeral costs and estate taxes. Ultimately, life insurance serves as a safety net, ensuring that your loved ones are financially protected and supported even when you're no longer around.

General insurance refers to a broad category of insurance policies that provide coverage for assets, liabilities, and other non-life-related risks. This includes protection for property (like your home or vehicle), business operations, travel, and personal liabilities. Unlike life insurance, which deals with the eventuality of death, general insurance covers losses and damages arising from accidents, theft, natural disasters, legal liabilities, and other unforeseen events. Common types of general insurance include motor insurance (for cars and bikes), home insurance (for property and belongings), travel insurance (for trip cancellations, medical emergencies abroad), and commercial insurance (for businesses and assets). These policies are typically annual contracts that can be renewed periodically. General insurance provides critical financial support when unexpected events occur, helping individuals and businesses recover quickly without suffering severe economic hardship. For example, a motor insurance policy can cover the costs of repair after an accident, while property insurance can compensate you for damage caused by fire or floods. By transferring the risk to the insurer, general insurance offers peace of mind and financial security, ensuring you’re not left facing massive out-of-pocket expenses during a crisis.

Health insurance is a vital financial tool that provides coverage for medical expenses arising from illness, injury, or preventive care. It helps reduce the financial burden of healthcare costs by covering hospitalization, surgeries, doctor visits, diagnostic tests, medications, and more, depending on the policy terms. Health insurance can be purchased individually, provided by an employer, or offered through government-sponsored schemes. Policies may include additional features such as maternity benefits, critical illness cover, ambulance charges, and access to a network of cashless hospitals. By paying a regular premium, policyholders are protected against unexpected healthcare expenses that might otherwise deplete savings or lead to debt. Health insurance not only ensures timely access to quality medical care but also encourages regular check-ups and preventive care, leading to better long-term health outcomes. In today’s world of rising medical costs and increasing health risks, having adequate health insurance is essential. It provides a safety net for you and your family, offering peace of mind and financial stability during medical emergencies. Moreover, many health insurance policies offer tax benefits, making them a smart choice for both health protection and financial planning.

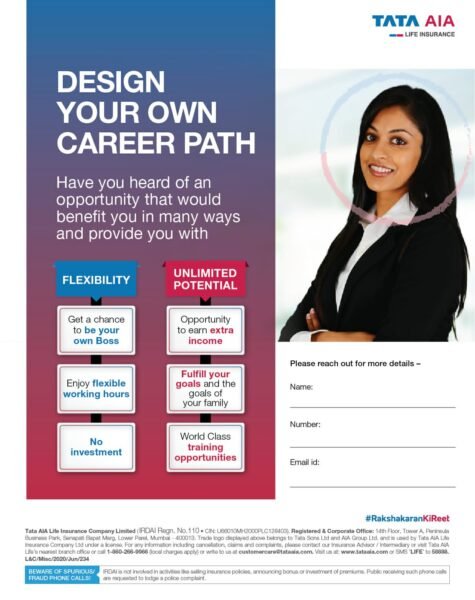

Join our team and help individuals and families protect their financial well-being. We're looking for motivated professionals to sell insurance policies and provide exceptional customer service.

Two career paths

Advisor

Leader

Responsibilities:

- Sell insurance policies

- Build client relationships

- Provide policy support

- For Leaders build and develop a team of advisor s

Requirements:

- Strong communication skills

- Sales experience (optional)

- Passionate to succeed

- Growth Mindset

- Min Education 10th

What We Offer:

- Competitive commissions

- Training and support

- Career growth opportunities